Transfer (mis)pricing of multinational enterprises: evidence from Finland

Published in VATT Working Papers 162, 2024

Abstract

This paper studies how firms manipulate their transfer prices to shift profit from high tax countries to low tax countries. Using detailed product-destination level firm data for years 2013-2019, I find evidence of Finnish multinational enterprises underpricing their exports to low tax destinations. By exploiting variation in corporate income tax rate differences and differences in the ownership of affiliates, I apply a triple difference estimation strategy. I find that a 1 percentage point increase in tax rate difference decreases export unit value by 1.2% among multinational firms exporting to low tax countries. My results suggest firms use transfer pricing as a complement channel, as firms more prone to other profit shifting mechanisms also underprice their exports more. Also, I provide evidence that transfer mispricing is concentrated in exports destined to countries where the multinational’s affiliate has a higher level of economic activity. Where the results with exports are very robust, the results with imports are mixed, suggesting an asymmetrical pattern in transfer pricing.

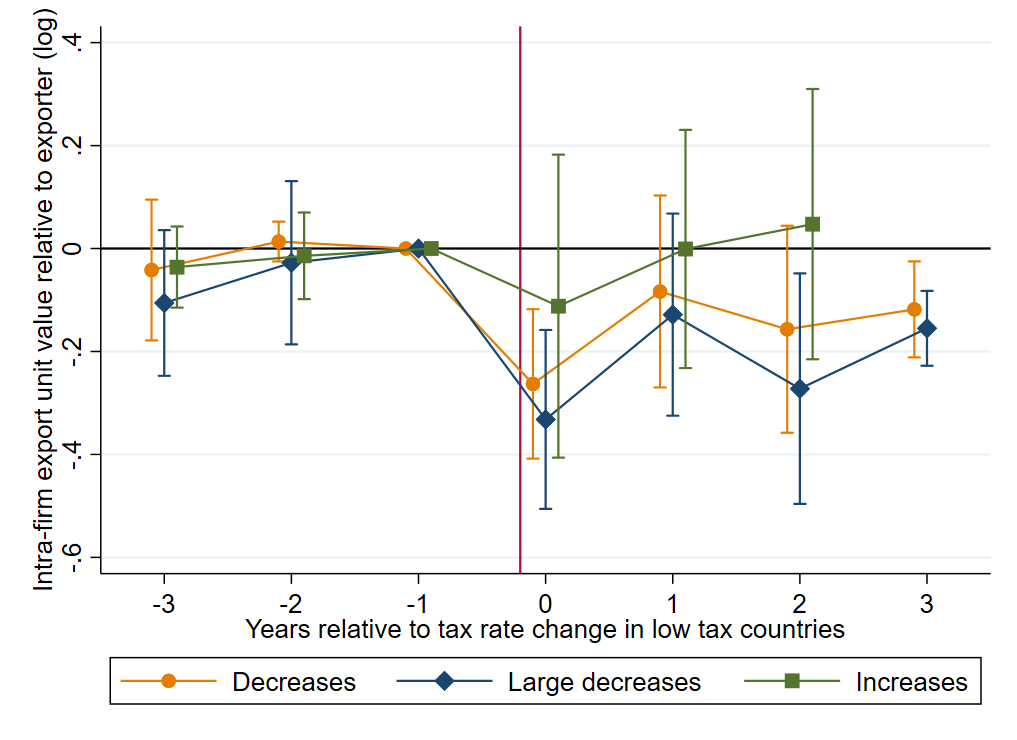

Effect of tax rate changes in low tax countries on the intra-firm export price

The figure plots event study estimates and the corresponding 95% confidence intervals for three different type of tax changes happening in year 0 in the low tax country. After the low tax country has decreased it’s corporate income tax rate (yellow and blue markers), the export unit value of a multinational that has an affiliate in that country decreases more compared to a firm that does not have any affiliates located in the country in question.

Recommended citation: Viertola, Marika. 2024. "Transfer (mis)pricing of multinational enterprises: evidence from Finland." VATT Working Papers 162.