Profit shifting of multinational enterprises: evidence from the Nordics

Published in FIT Working Paper 18, 2023

Abstract

This paper studies how Nordic multinational enterprises (MNEs) react to tax incentives generated by international corporate income tax rate differences and shift profit to low tax countries. A firm level panel data set containing ownership and accounting information is used to study profit shifting within the time period of 2012-2017. Applying a panel data adjusted Hines-Rice approach including firm and year fixed effects results in statistically significant tax semi-elasticity estimates between -0.7 to -1.3. The results are confirmed by several robustness checks as well as by applying the newest methods in two-way fixed effects literature. This suggests that MNEs with ultimate owners located in the Nordic countries seem to react to tax rate differences by shifting profit. Additionally, the MNEs within the euro area seem to engage more heavily in profit shifting.

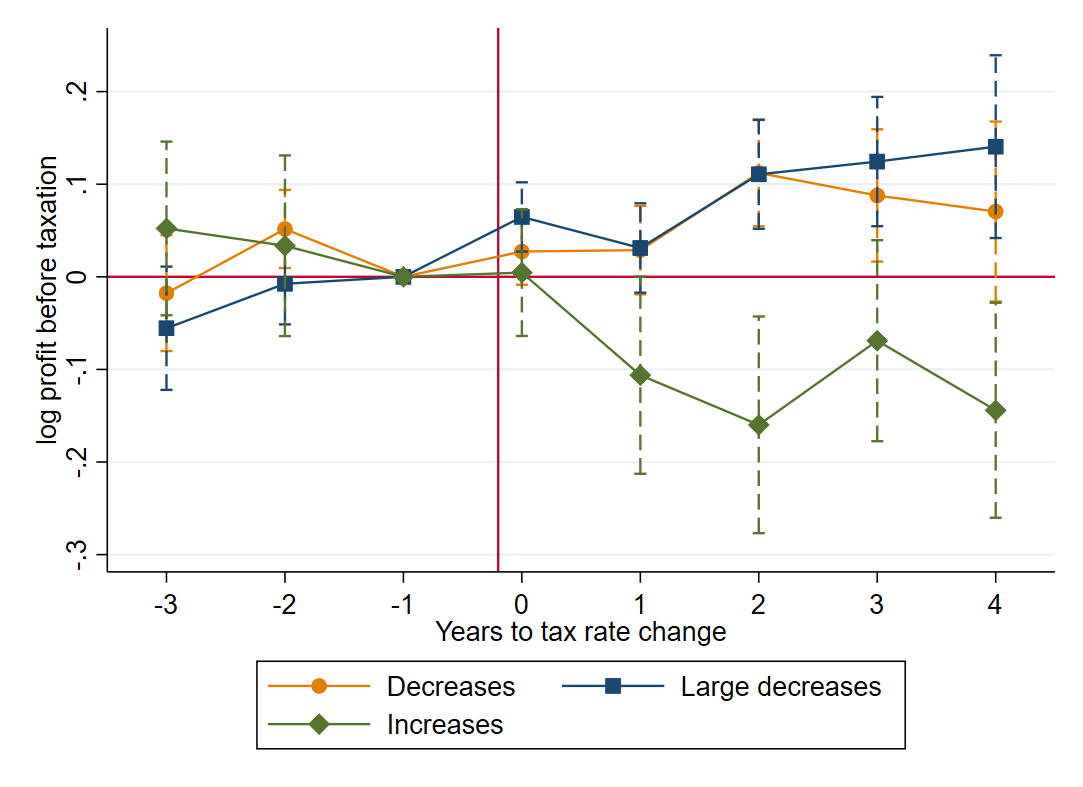

Effect of tax rate changes on (log) profit before taxation

The figure plots event study estimates and the corresponding 95% confidence intervals for three different type of tax changes happening in year 0 in the affiliate’s country. After the country has decreased it’s corporate income tax rate (yellow and blue markers), there is an increase in the (log) profit before taxation reported in that country. Similarly, after a country has increased its tax rate (green markers) there is a decrease in (log) profit before taxation reported by affiliates in that country.

Recommended citation: Viertola, Marika. 2023. "Profit shifting of multinational enterprises: evidence from the Nordics." FIT Working Paper 18.